School decision letters are coming in order to a house near your. Perhaps people on your domestic is pregnant one soon. What you may possibly not be expecting ‘s the slim financial aid honor package that comes with of several university greeting announcements.

Whenever you are school funding honours you will include 100 % free offers and reduced-rate of interest federal student loans, financing is limited and simply accessible to eligible college students and mothers. Tuition, charges, and you will living expenses ilies to take on alternative money supply.

Before deciding for the an extra financing option for your position, contrast the many benefits of having fun with a house security mortgage versus an excellent individual education loan to fund college or university expenditures.

Individual student loan credit limitations are in line with the college’s price of attendance, quicker one school funding gotten by the pupil. Exactly what if for example the student’s unanticipated college-relevant bills is higher than brand new pre-determined cost of attendance algorithm?

To greatly help the younger mature pay money for college, you need the better credit limitations regarding a property guarantee financing to fund school expenditures. These types of constraints was connected to the security of your home.

But, in lieu of individual student education loans, a property equity loan spends your home because collateral. For individuals who standard into the property guarantee financing, you risk dropping your home. Defaulting toward a private student loan doesn’t put your home at stake.

Into the 2018 2019 instructional year, 92% from college student consumers is only able to qualify for a personal financing which have the help of a creditworthy cosigner. Couples loan providers allows people which have a thinner credit reports accessibility so you’re able to an exclusive education loan rather than an effective cosigner, and that restrictions their capability to help you borrow funds.

One more benefit of playing with an effective cosigner is the fact payment craft appears in both the new student’s and you will cosigner’s credit report, that can assist with strengthening borrowing to the student.

However, there are many choice. Sidestep the need for the scholar so you can meet the requirements that have a beneficial cosigner by using a home equity financing as an alternative.

With a home security loan, your debt is in the homeowner’s identity, maybe not new student

Many school students are would love to get property or start a family because of the burden out of student loan personal debt. This might be a critical assist to teenagers going into the associates shortly after college or university.

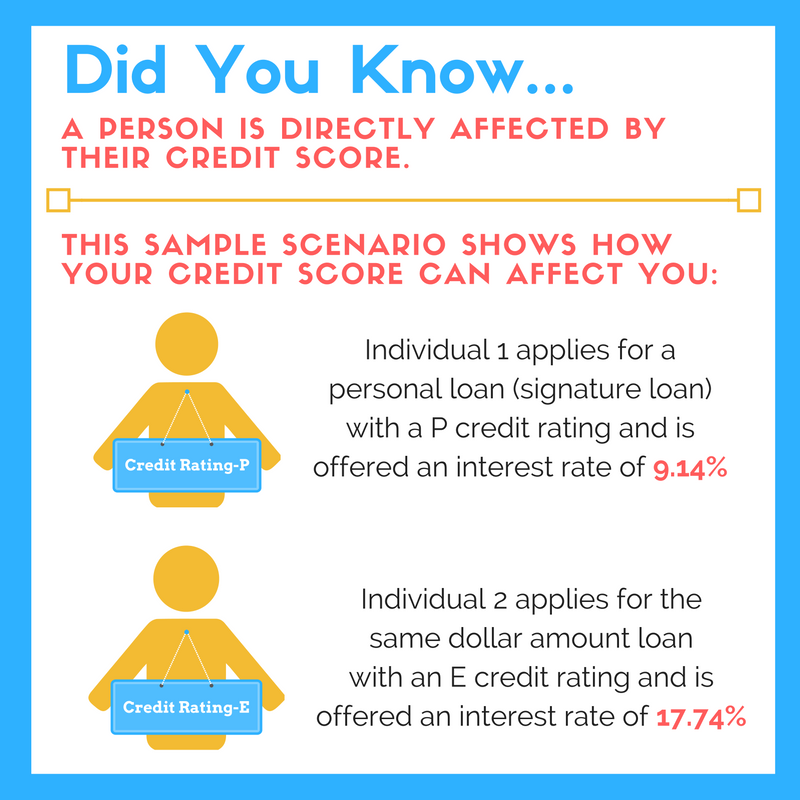

Personal student loan rates of interest are below exactly what might shell out to the a credit card, however, more than what a house equity mortgage could offer. Actually several commission affairs variation will cost you $step 1,000s. Eg, for folks who acquire $100,000 which have a beneficial 10-seasons cost term, a personal loan during the 7% attention will cost you over $twelve,000 more than a house collateral loan at the 5%.

Domestic collateral mortgage individuals will even need weigh the pros of numerous fees solutions that have personal figuratively speaking. Eg, income-situated installment terminology make it personal education loan consumers and also make costs according to its income or any other factors. They may together with qualify for payment deferments, age.g., zero needed mortgage costs up to shortly after graduation. Home equity financing do not offer this freedom.

A great cosigner may help the new scholar safe loan acceptance

Home collateral money provide offered fees symptoms that actually work getting borrowers who intend on staying in their houses for the predictable upcoming. In the event that, however, you’ve planned to sell your property soon, then chances are you will have to pay your house security mortgage for the complete to shut the offer. Private education loan consumers are available otherwise pick a separate household with no need to settle the brand new education loan balance.

ENB’s HomeLine is a kind of domestic collateral mortgage which provides the flexibleness of a house equity personal line of credit. It will provide the funds you will want to link the fresh new gap anywhere between college or university costs and you may scholar services packages. In place of a classic loan, which is paid KY installment loan in a single lump sum payment, HomeLine works as the property equity personal line of credit. Borrowers can protect a predetermined speed and you will supply cash just like the needed.

ENB’s iHELP Personal Student education loans can pay for school expenses otherwise be employed to consolidate higher rate of interest student loans. Find out more about reasonable-rates student education loans or incorporate today.