Backed by the brand new U.S. Department off Farming (USDA), these types of loans don’t need a down payment, but you’ll find rigid earnings and venue standards consumers need fulfill to help you meet the requirements.

Documents requirements: All of the candidates will have to bring proof the home condition given that U.S. noncitizen nationals or qualified aliens.

Traditional funds

A normal mortgage is actually any financial it is not supported by an authorities agency. Antique funds often want high minimal credit scores than regulators-supported funds and so are often stricter with respect to acceptable debt-to-income ratios, deposit wide variety and you may loan limitations.

Documents conditions: Consumers must offer a valid Personal Security amount otherwise Individual Taxpayer Personality Count together with proof of their current residency condition by way of a work consent document (EAD), eco-friendly credit or work charge.

Non-QM money

Non-qualified mortgage loans try mortgage brokers you to definitely fail to meet the Consumer Monetary Coverage Bureau’s capacity to repay laws, otherwise specifications that loan providers feedback good borrower’s earnings and place loan words that they are going to pay off. Such financing are generally accessible to consumers which can’t be eligible for traditional fund, constantly due to less than perfect credit, and feature highest interest rates, highest downpayment minimums, upfront charges or other will cost you accredited mortgage loans don’t possess. And additionally they have a tendency to include uncommon features like the ability to make notice-just repayments or balloon costs.

Qualified immigration statuses: Actually foreign nationals can also be qualify for low-QM financing, as many of them lenders do not require proof of You.S. earnings, You.S. credit or a social Cover amount.

Files criteria: Your normally don’t have to promote any proof of U.S. residency standing or a personal Cover matter, and you may alternatively you’ll just need to meet with the lenders’ earnings, discounts or any other simple requirements.

3. Collect files

Like any homebuyer, you should be happy to put on display your money, assets, deposit provider and credit rating. Additionally, you’ll be able to typically need to promote records of one’s house position to help you lenders. The following is a list of well-known personal data to have from the ready:

> Social Safety count: Really bodies and you can antique home loans want a legitimate Social Defense matter in order to be considered. In many cases, an individual Taxpayer Character Matter was acceptance, however, basically Social Coverage quantity is actually common.

> Residency: Loan providers want to see legitimate, unexpired proof of your current home status inside the You.S. It means legal permanent residents will need to offer their green notes and you may nonpermanent customers will have to inform you their visa or a career authorization document.

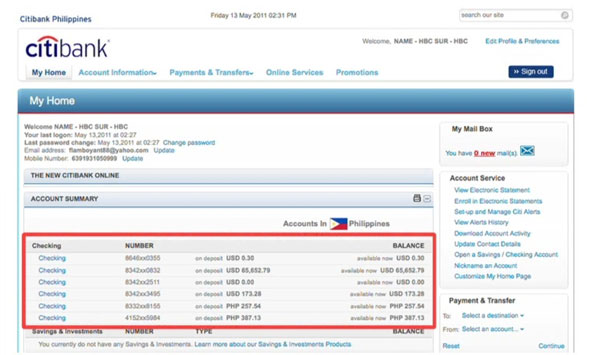

> Advance payment inside the U.S. dollars: Money to suit your down payment and you can settlement costs have to be within the You.S. cash in a U.S. bank account. If the that money in the first place came from a different membership, you’ll want to promote proof its exchange to U.S. cash. Lenders love to select an everyday balance for at least one or two weeks prior to the app.

> Income when you look at the U.S. dollars: Be prepared to let you know loan providers at the least the past a few years’ money background, constantly as a consequence of W-2s or government tax returns, Altoona loans and you will show current work. People costs or earnings obtained off a different business otherwise an effective international bodies when you look at the another money need to be interpreted in order to dollars.

> Credit score: Lenders will look at the You.S. credit rating and you will credit file from 1 or maybe more of the about three federal credit bureaus: Experian, Equifax and TransUnion. Should your credit is simply too the fresh new on account of too little enough U.S. credit score, the lending company may use borrowing from the bank recommendations from a different nation, offered it meet up with the exact same conditions getting home-based profile consequently they are capable of being translated with the English. Lenders also can accept good nontraditional credit history, for instance the prior 12 months’ book otherwise utility repayments.