Once the home loan crisis from a decade ago may have altered the way in which mortgage loans are provided, the financial institution statement loan program remains available in proper things. Such low-licensed mortgage loan requires certain paperwork towards downpayment and you will income, however it will be a beneficial option non-qm loan option for tens of thousands of mind-employed people that need a mortgage.

How can Bank Declaration Fund Performs?

Lender declaration financing was basically also known as mentioned income. In the event that a borrower got an adequately satisfactory credit rating, always 700 or higher, then your mortgage lender would allow the fresh new borrower to locate good loan versus delivering taxation statements, lender comments, or any other types of files.

When you find yourself progressive financial statement funds commonly so easy, they still promote good financing choice to owners of their particular people.

Smart entrepreneurs hire top-notch income tax accountants to enable them to get advantage of the income tax law and reduce their company income having legal deductions, for this reason decreasing its tax liability at the end of the entire year.

Although not, the lower money claimed with the tax returns inhibits business owners off being qualified for the household of the desires. This is where the alternative documentation may come when you look at the convenient and you will allows financing consumers to utilize lender statements to show its earnings in another way.

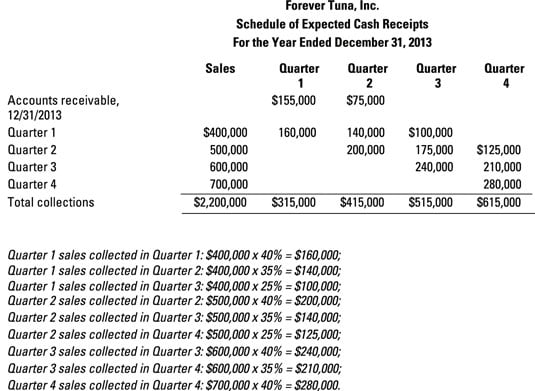

The contrary records uses their lender comments out of one year otherwise two years. Bank comments will teach dumps to your savings account over the longterm and you may mean that the firm are generating a profit that people are utilizing for their personal use.

Loan providers have a tendency to mediocre all the eligible places then explore a portion number of an average to determine the borrower’s annual earnings.

Chief Benefits of These types of Home loan against a vintage Financial

- Individuals can be qualify for a high amount borrowed versus earnings said on their taxation statements.

- Doesn’t need tax statements or any other evidence of spend

- Down payments can be as lower once the 10%

- A bit highest Rates of interest for these fund than just pricing to possess mortgage loans offered by Freddie Mac computer and Fannie mae

Standard Guidelines into Worry about-Employed Financial Debtor

Just before plunging to your one of them mortgages, individuals should be familiar with the essential requirements observe if they be eligible for the borrowed funds

- Every individuals have to be mind-functioning. Furthermore, make an effort to reveal that you have been thinking-useful for two years lowest together with your current organization

- Minimal deposit to have a buy was at least 10%

- Individuals will need to offer duplicates from personal or company bank statements to help you qualify in lieu of taxation statements (according to where money is actually transferred) during the last several in order to two years.

- Individuals needs enough reserves that will will vary oriented to the multiple affairs. The financial institution also make sure the assets.

Jumbo Bank Statement Financial System Possibilities

Jumbo mortgages have been in existence for a long time but to qualify for a loan is usually a little more limiting than simply conventional finance. Enhance that fact that of many jumbo mortgages want an effective 15% deposit or higher, and you can understand why individuals timid away from these types of deals.

This mortgage takes away among those traps. Provided that you’ve got a credit score of at least 620, in addition to the needed reserves, which financial could be a terrific way to make it easier to funds the next jumbo domestic pick.

Investment Properties

Those people who are thinking-functioning and have achievements within their businesses are constantly finding a means to diversify its investment and construct wealth money for hard times. Perhaps one of the most common suggests are to get money spent instance as a rental property or a multi-unit building. Financial report money can help with which too.

A vintage mortgage to have an investment property would need the brand new borrower in order to file their personal income that have tax returns, W-2 forms, and you can team taxation statements because of their providers. They would also desire to pick a revenue and loss report towards suggested money spent one to displayed annual book income, vacancies, and you may needed repairs fees.

Lender declaration money make it much better to pick a good investment assets. With a down payment ranging from 20% in order to 25%, certified borrowers can buy a home and start on the street to be a property owner. The new reserve requirements mentioned prior to are in essence to have a financial investment mortgage too.

Cash-Aside Re-finance

This method isnt arranged simply for buy transactions. Utilizing the same credit score, dollars reserves, and amount borrowed criteria, individuals having existing mortgages can also make an application for a cash-out refinance mortgage. Most of the exact same legislation tend to get a financial declaration refinance.

Certain Words to own Cost

There are many payment conditions, identical to a traditional home loan. Consumers can get like a thirty-season repaired home loan or one of many multiple varying rate mortgage programs like a beneficial 5-12 months Case or seven-12 months Case. Interest-merely is also a readily available choice however, almost every other restrictions go with it.

Supplier Concessions are Anticipate

To order a house will bring https://paydayloanalabama.com/westover/ involved the required closing costs. Talking about costs repaid towards appraiser, closure lawyer, or any other providers that take part in the mortgage techniques. To aid individuals through its deals, this choice enable sellers so you can contribute doing 6% of your own house’s selling price for the closing costs.

If it should be discussed amongst the real estate professionals accurately, it will help reduce the borrower’s overall aside-of-wallet expenditures at the time of closure.

Summing-up The lending company Report Home mortgage System getting Worry about-Functioning Individuals

To have mind-functioning individuals with a strong credit score and you may a healthy wet-go out fund, the strain of lender statement mortgage loans are going to be an excellent treatment for purchase property otherwise money spent without having any regular documents of the financial.