Credit history Calculation of the Experian – Procedure.

For instance the almost every other credit agencies in the united states, Experian has a lot of creditors which can be the participants. These types of organizations also provide NBFCs plus finance companies because they fill in the financing study of one’s borrowers so you can Experian. All these submissions began in guidelines of Set aside Lender out of Asia away from Borrowing from the bank recommendations enterprises regulation act 2005.

Experian uses everything through the borrowing from the bank information report. There are a lot of the primary components of the financing records investigation and you can a formula which can build your own step three-hand credit score anywhere between three hundred and you will 850..

Today ,that you have the very thought of the financing monitoring techniques from inside the experian, lets know how borrowing overseeing is processed away from Experian and you can Transunion

Exactly what are the great things about which have good credit?

The second gurus are only available to people that take care of good clean and uniform fee record and get a premier credit history.

You’ll found that loan at the Low-interest rates.

Having a good credit rating can be quite advantageous for your requirements. It will make your qualify for financing which have a minimal-interest rate. Hence it can make it better to pay-off your debt instead any difficulty. You will want to hear this simply because actually a 1 / 2 per cent upsurge in the pace can impact your money.

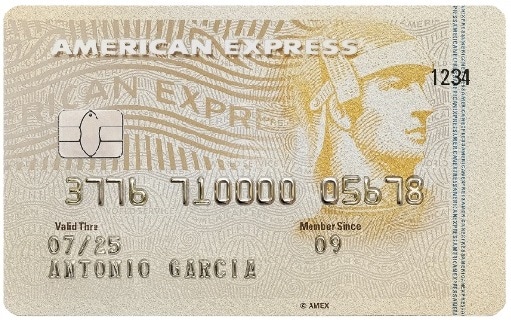

You can aquire instant acceptance for a charge card and you will mortgage.

If you have a top credit score, it can show lenders their creditworthiness, that leads them to give you instant financing recognition. And therefore, consumers having advanced level credit ratings will benefit on quick acceptance out-of money and you can playing cards. This is very important when you have one emergency and want a fund instantly.

Furthermore, loan providers, banking institutions, and you may financial institutions refute the latest individuals that have less than perfect credit studies given that of its unsound credit histories. You will want to understand that individuals additional factors might also be believed once you make an application for a loan otherwise purchase a Kim cash advance loans charge card.

You’ll have finest negotiations power into lender

A great credit score will give you the benefit so you can negotiate to the the reduced interest rates or towards the a very significant amount borrowed regarding the lenders. Thus, a good credit score can raise brand new negotiating energy out-of borrowers. Besides this, it will actually entitle the latest debtor to track down unique deals, income, and offers.

You have got a good chance of going a premier limitation to your new money.

A person’s credit history and you will money are utilized from the lending associations and you will banking companies to choose how much cash he or she can borrow. Banking and loan providers are more inclined to make you an excellent an excellent mortgage in case your credit score try highest. The highest credit history allows you to a debtor. not, when the borrower keeps a reduced credit history and you will desires a great financing. The borrowed funds might possibly be recognized, nevertheless financial have a tendency to fees higher interest levels.

You can easily rating a high maximum on your bank card.

Lending establishments and banking institutions fool around with your credit score and you can income to choose exactly how much they could borrow. You can aquire an educated interest levels, perks, income, coupons, and cashback also provides because of these cards. Be sure to repay your handmade cards and you can loans into the day while you are considering to shop for something extraordinary with many advantages.

You can buy the potential for getting a long tenure.

A good credit score often leads that a high possibility of getting a longer tenure on your own financing. A longer tenure lowers your own month-to-month Emis, that can help you maintain your earnings securely.