Comforts such as for example mobile bank places try sweet, but how far are they costing you? Their declaration will most likely not reveal the expense really, but there’s an old adage in the activities in this way: If you’re not paying for a support, you are not the customer. You are this product. In this situation, corporate banking companies use smooth technological great features to get you into the so you’re going to be prone to take-out financing and explore most other to have-shell out services. While you are sick and tired of undergoing treatment for example a product or service, you are not alone. This past year, dos billion anybody between the ages of 18 and you can thirty five registered a cards partnership. In fact, 28% of borrowing from the bank connection participants is under thirty-five when you are 54% of them was under age 50. The tools regarding technical are making they better to understand the well worth one borrowing unions bring. Don’t simply need all of our phrase because of it. Do your research and view for yourself just how borrowing from the bank unions evaluate to help you to have-earnings financial institutions.

1. Ease of solution

Here’s an enjoyable game. Name a business financial that have a simple request, for example checking the bill away from a checking account. Matter the amount of annoying cell phone forest menus you have to dig through before you can communicate with a bona fide person that could answr fully your concern. Your victory if you get mad and you can slam the device down into the rage! For-earnings finance companies are entitled to a reputation to have cumbersome customer care and you can out-of-touching formula. Borrowing from the bank unions, likewise, provide effortless-to-play with features and you may actual, live people who will answer questions, create guidance which help you know the tricky field of financing.

2. Lending means

For-earnings banking institutions way to corporate citizens. It assume a predictable, stable rate away from get back on the investments. So it consult places a straitjacket on the financing and you will assures men and women means never deviate out-of a predetermined algorithm. There isn’t any place getting liberty and interest levels is greater. Borrowing unions is actually people institutions, thus helping someone out belongs to what they do. Its costs were less than that from corporate financial institutions. Nevertheless they tend to be more ready to build exclusions having information which can not be mirrored in the traditional financing formula.

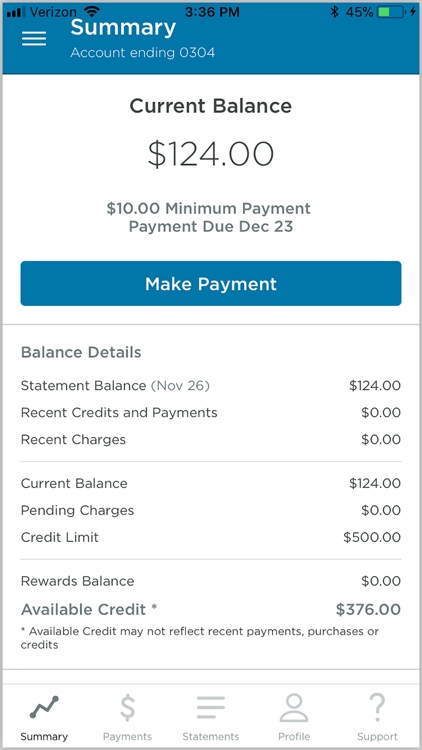

step three. On line banking is actually almost everywhere

In the great outdoors West days of the web, only corporate finance companies you may manage on line financial. Today, the animal gerbil might have his personal web site. The online is actually every-where and you will credit unions take panel. The support you use each and every day, such on line costs spend, head deposit and you can looking into membership stability are just a view here out.

4. Instructional information

Business financial institutions provides usually made a killing by keeping members of the fresh ebony regarding their means. Creditors made it tough to tell simply how much notice you were being billed. Banks billed overdraft charge versus actually letting you know these people were starting it. These things had so very bad, Congress grabbed step. Individual lack of knowledge is actually built into the new profit make of big monetary organizations. Educating people wasn’t simply a complete waste of currency to them, it absolutely was in reality charging all of them company. Borrowing unions aren’t-for-earnings that need and also make its groups a much better put. Element of that purpose is sold with monetary training. If you want advice about real estate, and make a spending plan otherwise playing with credit sensibly, the borrowing from the bank relationship might be willing to assist.

5. Savings

Borrowing unions work with the people. They pay off the bucks they generate on their players in the form of returns. Since their people are the people spending money on their attributes, they do not have the majority of an incentive to fees a supply and a toes in the attention and you will charge. Borrowing from the bank unions also provide aggressive costs on the offers accounts and share certificates. Because they do not need siphon from currency to pay investors, they can return that cash on the buyers: you are sure that, individuals who do the payday loans Ashville banking to your borrowing from the bank unionpare the newest made appeal towards the a credit union checking or family savings so you can the individuals given by an as-finances financial. Then, go discover an account at the a cards commitment. You’ll give thanks to yourself after.